Introduction

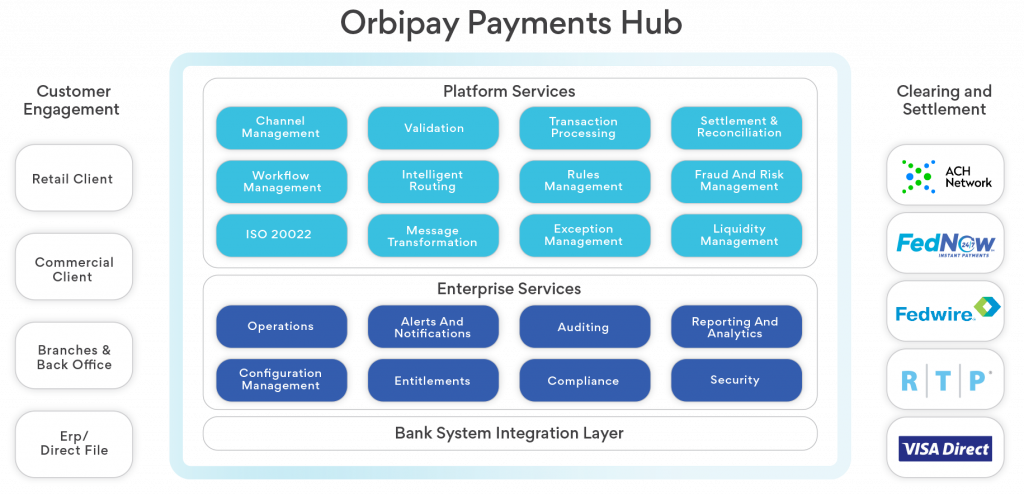

The Orbipay Payments Hub is a powerful platform that integrates with real-time payments platforms enabling faster payments-as-a-service along with rich messaging capabilities. You can use Payments Hub to process payments between businesses, and individuals, to send payments to recipients, and route payments from customers. The platform supports initiating and receiving payments.

Payments Hub powers payments for business models like marketplaces and software platforms. The Payments Hub API helps you to manage real-time payments within your banking system. The API complies with ISO 20022 to capture requests and process payments and perform related functions.

The API supports a host of functions whether you are a debtor agent (sending funds) or a creditor

agent (receiving funds).

Intended Use

This guide is for use by analysts and developers at banks, credit unions, and financial institutions, who intend to offer real-time payments to their customers. The guide provides information that will enable you to evaluate the software service, test use cases that are suitable to your business need, and to integrate the service with your banking systems.

Before Onboarding

For you to be able to onboard on to the Payments Hub platform, you will need access to Payments Hub API keys. To get the API keys, please get in touch with Payments Hub support. Using the Payments Hub support, you can onboard on to the Payments Hub platform easily.

Concepts

| Concept | Description |

|---|---|

| Real Time Payments | Real time payments enable businesses and consumers to make and receive payments in real time, providing convenience, speed, finality and faster availability of funds. |

| Real Time Payment

Messaging Types |

The ISO 20022 prescribes the following message types:

Credit transfer:Basic multipurpose push payment message including remittance information. Request for payment: Request for information:Payment receiver requests additional information about a payment. Remittance advice: Extensive remittance detail is included in addition to the credit transfer message. Payment acknowledgement by receiver: Status messages from the receiver to the sender regarding payment transfer. |

| Clientt | A business entity that is a tenant in Payments Hub. You integrate Payments Hub capabilities into your system to provide real-time payments to your customers. |

| Creditor | The beneficiary of the payment whose account is credited with the funds. |

| Creditor Agent | The financial institution where the creditor holds the account that receives funds. |

| Debtor | The customer that acts on a payment request, whose account is debited with the funds. |

| Debtor Agent | The financial institution where the debtor holds the account from which the funds are sent out. |

| Initiating Party | The party that initiates a transaction. This could be a debtor of the bank (FI) or one that is authorized by the debtor to initiate the transaction on behalf of the debtor. |

| Funding Agent | The financial institution that manages liquidity within the network on behalf of its designated banking entities. |

Personas

Payments Hub for RTP allows clients (FIs) to either only receive funds, the Receive Persona, or both send and receive funds, the Send and Receive Persona. These persona are only with respect to sending and receiving funds and have no bearing on the other transactions like RFP, RFI and RROF.

Typical Use Cases

Some of the common use cases that are relevant for real-time payments include,

- Instant Bill payment.

- Enhanced cash management.

- Vendor payments.

- Digital Wallet Funding.

- Business to consumer disbursements.

The use cases are illustrated here from the point of view of the financial institution, that is a Payments Hub client.

Financial Institution as a Debtor Agent

The financial institution plays the role of an agent for parties that respond to requests for payment, and interfaces with Payments Hub to process the requests for different possible outcomes.

Consumer Bill Pay

A typical consumer bill pay scenario, where a bill is issued by a utility or a bank on behalf of a utility.

The bank requests the consumer’s bank to pay, and the consumer’s bank sends the request to the consumer for action on the request. The consumer can,

- Accept.

- Issue a consumer query (Ask for additional information).

- Reject.

- The issuer of the request can cancel the request.

Network

Payment Hub

Consumer agent

Debtor agent

Consumer Debtor

Corporate Account Payable

Corporate Accounts Payables are either business-to-business (B2B) or business-to-consumer (B2C) transactions between a corporate and its suppliers, vendors or consultants. The request for payment is issued by a supplier to the corporate who owes the money. The corporate agent sends the message requesting action from the corporate. The corporate can,

- Accept

- Issue a Corporate Query (Ask for additional information).

- Reject

Network

Payment Hub

Corporate agent

Debtor agent

Corporate Debtor

Corporate Payroll

Corporate Debtor

Corporate agent

Debtor agent

Payment Hub

Network

Corporate Disbursements

Corporate Debtor

Corporate agent

Debtor agent

Payment Hub

Network

Government Benefit Payouts

When government has to pay to its citizens as part of benefits like unemployment, real time payments can be executed between a government account and citizen accounts using Payments Hub.

Government Debtor

Government agent

Debtor agent

Payment Hub

Network

Digital Wallet Funding

There are several use cases for real time payments between accounts including digital wallet funding where a credit transfer is done into a digital wallet.

Individual Debtor

Individual agent

Debtor agent

Payment Hub

Network

Request for Return of Funds

If a transaction is performed twice or is erroneously made, RTP supports a request for return of funds (RROF).

Individual Debtor

Individual agent

Debtor agent

Payment Hub

Network

Financial Institution as Creditor Agent

The financial institution plays the role of an agent for parties that receives payment on behalf of the creditor, and interfaces with Payments Hub to process the requests for different possible outcomes.

Merchant Bill Pay Collection

Bill collection by merchants are business-to-business (B2B) or business-to-consumer (B2C) transactions. The merchant issues a request for payment to the merchant’s bank which is sent to the payer’s bank. The payer’s bank sends the message requesting action by the payer. The payer can,

- Accept

- Issue a Debtor query (Ask for additional information).

- Reject

The Merchant can cancel the request.

Biller (Creditor)

Biller agent (Creditor agent)

Payment Hub

Network

Corporate Account Receivable

Corporate Accounts Receivables are either business-to-business (B2B) or business-to-consumer (B2C) transactions between a corporate and its clients.

When a payment is made by a customer to a Corporate, the corporate can,

- Accept

- Ask for additional information.

Network

Payment Hub

Corporate agent

Creditor agent

Corporate (Creditor)

Conditions

Fund transfers enabled by Payments Hub for RTP messaging have certain conditions to meet:

- The Orbipay Payments Hub for RTP supports only Credit Push or Customer Initiated Credit Transfers. This means that funds once transferred cannot be reversed. However, a debtor can request for return of funds from the creditor. Creditor can choose to accept or reject the request. Even if the creditor accepts the Request to return of funds, the actual reversal of funds is an explicit credit transfer from the creditor quoting the reference to the Request for return of funds.

- A request for payment sent by a creditor to a debtor can be accepted or rejected by the debtor. However, the debtor accepting a request for payment received does not imply that the funds will be transferred to the creditor. The fund transfer or payment against a request for payment has to be made explicitly quoting the reference to the request for payment.

Developer Journey

You can use the information and procedures here to set up the Payments Hub sandbox environment for evaluation purposes, and subsequently integrating Payments Hub with your production environment. Payments Hub currently supports some standard integrations with bank cores. For others, you will need to contact Alacriti.

As part of the developer journey, you will go through the following stages:

- Setting up the sandbox

- Code Integration

- Validating the Integration

- Production Checklist

- Migrating to Production

Supported Integrations

The Orbipay Payments Hub currently supports the following integrations out of the box:

- FIS! IBS core via Code Connect.

- Jack Henry!s Episys via SymExchange.

API Keys

To get started with Payments Hub evaluation, you will need to generate the following API keys. These keys are specific to the environment and vary from sandbox to production. The keys help identify and authenticate API requests. When you sign up to use Payments Hub, you will be provided with unique API Keys for Sandbox and Production environments.

There are three types of keys:

Client Key: To identify the tenant, the subscriber to Payments Hub service.

API Public Key: Identifies the entity that is making the API request. Typically, the Client Key and the API Public Key correspond to each other, one-to-one. However, this could vary when hierarchical tenancy needs to be supported.

API Secret Key: The combination of the API Public Key and the API Secret key is used to create a signature that is used when making requests.

Authentication

Requests are authenticated using the api_key that is shared with you at the time of on-boarding. You can invoke those APIs based on the permissions assigned to the api_key. Refer to the API Reference to know more about how authentication is handled.

Setting up the Sandbox

To get started with your evaluation, you will need an evaluation and integration environment set up

for you.

Your credentials, users in your team and API Keys are created by Payments Hub Support.

Using the API keys, you can access the Payments Hub API.

Now you can invoke the APIs to test the use cases.

Resources Required

In order for us to set you up for a trial. We need the following information:

- Core banking provider details.

- General Ledger, transaction codes and Cost centre information that will be used during evaluation.

- If your bank has a provider for risk service, share the provider’s details. (Optional)

- Whether you want to evaluate the send/receive or only receive persona.

- The RTP functions supported by your bank.

- Participant ID and routing number for setting up RTP.

- RTP funding agent details. You will need these details during integration even if you don’t choose to

use in the evaluation. (Optional) - Your risk profile. This typically includes AML rules, List of Negative entities, and OFAC white lists.

(Optional). Payments Hub provides a default risk profile. - Your workflow template including transaction preference for queuing and retry.

Sign off on Sandbox

Once you have validated the use cases to your satisfaction, you are good to sign off on evaluation and prepare to migrate to production on Payments Hub.

Please contact the Payments Hub support team at Alacriti to validate the integration.

Migrating to Production